Biden Tax Compliance Proposal

Summary: Republican messaging against the Biden tax compliance proposal is powerful and potent, if misleading. Senator Ron Wyden’s message, which describes the problem and how Democrats aim to address it, was broadly effective at countering Republican messaging. Most other messages we tested were not effective.

This research was conducted in partnership with Strategic Victory Fund.

Background

This week, we explored the issue of the Biden administration’s proposal to require banks and financial institutions to report annual deposits and withdrawals for certain types of accounts to the IRS, in order to increase tax compliance. This proposal has faced intense opposition from Republicans and the banking lobby, including many mischaracterizations and lots of misinformation.

Audience Understanding Survey

On October 26, we conducted an Audience Understanding Survey in order to better understand what both supporters and opponents think about this issue, including their feelings, the values they bring to bear, their motivations for their position, and how they describe their feelings in their own words. We used this quantitative and qualitative information to inform message generation for the message test that followed.

Supporters tended to mention “fairness” and “catching cheaters” in the open-ended responses, with a few people intuiting that this measure would primarily target rich people. Opponents overwhelmingly identified this as an “invasion of privacy”. Some people who were undecided said that they simply didn’t know enough about the issue to make up their minds, but others were legitimately conflicted, saying things like “I don’t like the idea of the government invading privacy but I also don’t like the idea of people cheating.”

We also saw that supporters tended to apply values including “fairness,” “obeying laws,” and “honesty” when thinking about this issue.

Based on this analysis, we drafted messages that aimed to either increase the importance of certain values, or that provided information that could lead to greater understanding and support of the proposal.

Rapid Message Test

On October 28, we conducted a Rapid Message Test to measure the effects of messages on opinions on the issue in a context of misinformation that’s being propagated by Republicans.

In the test, respondents were either assigned to a placebo group, or to one of seven message groups. For everyone who wasn’t assigned to the placebo, they first saw an “opposition message” from Mitch McConnell. This message, excerpted from a recent USA Today opinion piece, relies on increasing people’s sense that this proposal would function as a massive increase in government surveillance.

We tested a range of messages, including two that simply provided factual information, one that was based on language that Senator Ron Wyden recently used, one based on patriotism and duty, and two based on fairness. We also assigned a group of voters to receive the Mitch McConnell message and a placebo message, so we could see the effects of the McConnell message alone.

Full text of all messages is in the Appendix, below.

Findings

Baseline support for the proposal was just 35%, while opposition was at 47%. As in the Audience Understanding Survey, we saw that many voters start undecided on this issue.

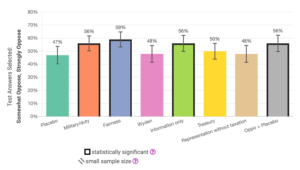

The McConnell message was a potent message against the proposal, increasing opposition among respondents by a statistically significant 9 points (gray bar on far right below). This opposition message, while misleading, taps into real fears that people have about perceived government overreach and surveillance.

Most messages we tested failed to counter that effect — in general, respondents were still moved toward opposing the proposal after they saw the McConnell message and a message in support.

Opposition to the proposal by message

Opposition to the proposal by message

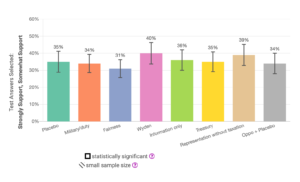

The Ron Wyden message was most effective at countering the McConnell message, causing an overall increase in support and preventing an increase in opposition. Support among people who saw the Wyden and McConnell messages was 5 points higher than in the placebo group, and opposition was essentially flat (pink bar in the middle of the graphic).

Support for the proposal by message

Support for the proposal by message

Building majority support for this proposal may be very challenging in the face of Republicans’ misinformation campaign, but it’s heartening to know that the language Wyden is using as Senate Finance Committee Chair is effective at countering it.

Appendix

Messages and outcome questions

Participants saw the following opposition message:

Opposition message

Senator Mitch McConnell:

Democrats’ latest gambit is a plot to give the IRS sweeping new authority to snoop on Americans’ personal finances, providing federal agents with data on every transaction over $600. This unprecedented expansion of government surveillance should leave everyone alarmed and outraged.

In effect, Washington liberals want to let the IRS leaf through Americans’ checking accounts as if everyone were a potential criminal or terrorist until proven otherwise. The IRS already knows how much you earn. Now they want to know exactly how you spend it.

In addition to one of the following messages or the placebo:

Military/patriotism/duty

As a soldier, I’m grateful for those who do the right thing and pay the taxes they owe. And most people do. Those people make it possible for us to be out here protecting the nation. So I don’t really have a problem with the new plan to catch tax cheats. My income and my wife’s income gets sent to the IRS once a year already, so it seems right for them to be able to check and make sure everyone else is doing their duty.

Fairness

Cheats. Freeloaders. Parasites! I don’t have a lot of good things to say about people who cheat on their taxes while I pay mine. Someone said “integrity is what you do when no one’s watching,” so I guess there’s a lot of folks with no integrity who aren’t paying what they owe. The government’s new plan is to check in with their banks once a year to make sure they’re following the rules, and I’m all for that.

Wyden

Senator Ron Wyden:

The total amount of taxes evaded each year may be as high as $1 trillion.

Cheating by those at the top is one of the major causes of that tax gap, partly because the automatic reporting and strict rules that apply to typical working taxpayers do not apply to many at the top whose income is derived from opaque business structures. Wealthy tax cheats are ripping off the American people to the tune of billions and billions of dollars per year. Democrats want to fix this broken approach and crack down on the cheating at the top.

Information only

The federal government is considering a plan that would increase IRS monitoring of high value bank accounts in order to reduce tax evasion. Banks would provide annual reports on accounts with at least $10,000 in deposits or withdrawals, NOT including money from regular paychecks or government benefits. The proposal is estimated to allow the government to collect an additional $460 billion over the next decade by making sure people with unreported income pay their required taxes.

Treasury

When the IRS has information from third parties, income is accurately reported, and taxes are fully paid. However, high-income taxpayers disproportionately accrue income in opaque sources–like partnership and proprietorship income—where the IRS struggles to verify tax filings. As a result, up to 55% of taxes owed on these less visible income streams is unpaid, with disproportionate levels of non-compliance for those at the top of the income distribution. The tax administration reforms proposed in the American Families Plan will provide the IRS with more complete information about these sources of income.

Representation without taxation

You know most of the people who don’t pay taxes still get to vote, right? And they do vote—for lots of candidates that pass loopholes and make it easier for the wealthy to commit tax fraud. Basically what we’ve got is a system of representation without taxation. That doesn’t feel very fair—especially when the rest of us pay what we owe. That’s why I support the government in adding extra monitoring to the bank accounts of the rich. Let’s close the extra loopholes and make sure everyone pays.

Oppo + placebo

Your local Helpful Honda Dealer is here for you in these unprecedented times. We get you where you need to go, safety first.

After randomized message exposure, the test participants were then asked the following question:

The federal government is considering a proposal that would increase IRS monitoring of bank accounts in order to reduce tax evasion. Banks would provide annual reports on accounts with at least $10,000 in deposits or withdrawals, not counting deposits from paychecks or government benefits. The proposal is estimated to allow the government to collect an additional $460 billion over the next decade through increased compliance.

Do you support or oppose this proposal?

Answer options:

- Strongly support

- Somewhat support

- Neither support nor oppose

- Somewhat oppose

- Strongly oppose

Key Experiment Details

- Audience: All adults, balanced on age, race, and gender

- Geography: the United States

- Sample size (raw / weighted): 1,600 / 1,600

- Dates in field: Wednesday, October 27, 2021 to Thursday, October 28, 2021

- Weighting factors: age, race, gender, education, and party